Bitcoin is a global currency system

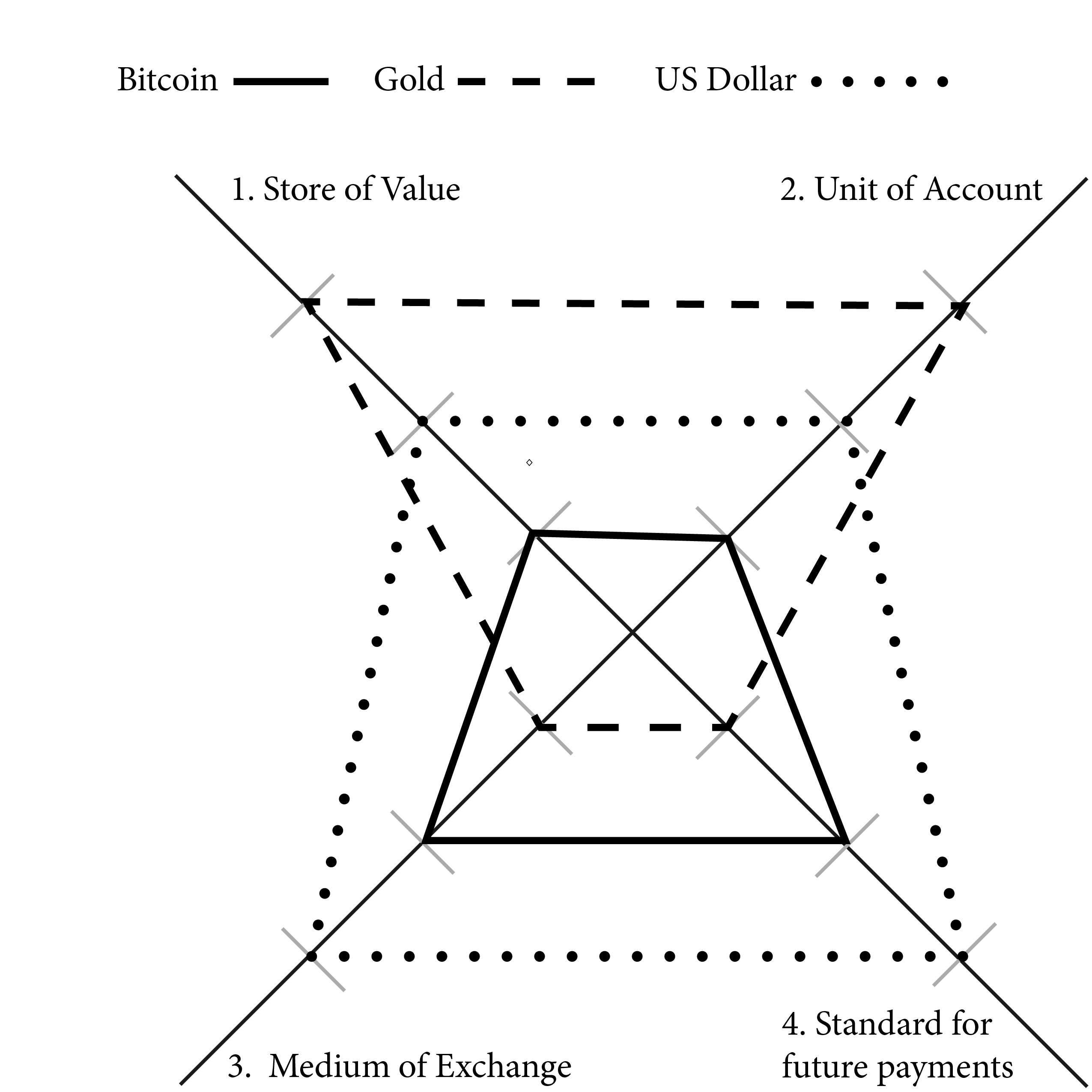

Explore how well Bitcoin performs on the four functions of money and how well it compares to a variety of other assets like USD, XAU, Bitcoin Cash and Litecoin! Lets first have a look at the requirements for currency systems and then evaluate how well Bitcoin has been designed to align to these functions of currency.

But how well has Bitcoin been designed?

Lets have a look at the functions Bitcoin should be able to perform.

1. Unit of Account-function

The currency can be used to balance workload within the economy. Calculating the costs of future activities should not require economic entities to re-calculate the costs of these activities before taking place.

3. Medium of exchange

The currency must be easily used in economic transactions as an instrument for exchange. Another prequisite for currency is that there are possible trades to be made and merchants accept the currency as payment.

2. Store of value

Currency should act as a store of value in order to avoid chaos. This means that when you buy a likewise product at two different moments in time, the total amount of currency (Satoshi’s) needed to buy the product at a later date should be roughly the same as the first date.

4. Expected standard for future payments

For a currency to be adopted on a global scale, market participants should be able to reasonably expect they can use the currency in the future as payment for goods and services, debts and taxes.

If Bitcoin fails on one of these functions, its global adoption will be in danger.

Lets compare Bitcoin with other currencies like US Dollars and physical gold and find out how well it performs on the four functions of money compared to the others.

Bitcoin versus us dollar and gold

In this comparison we’ll use the method presented in the book ‘On the Nature of Bitcoin’ and use formal logic to compare Bitcoin to the US Dollar and physical gold on the four functions of money. Each asset is compared among the other assets and the one performing best on each specific function of money receives three points (3), while the second asset receives two (2) and the third asset just one (1) point. This comparison results in the above model and shows the rank score of each individual asset on each individual function of money.

When you look at the comperative model, you see that Bitcoin does not outperform US Dollar based credit systems nor physical gold on each of the individual functions of money.

However, the crypto system does align to the four functions of money more or less and even outshines gold as a medium of exchange. Lets therefore see what reasons are there to support the rank scores on two functions.

Store of value function

Why does Bitcoin performs the least on the store of value function compared to US Dollars and gold?

It depends on how you evaluate the relevancy of consumer behaviour on the function itself. If consumers aren’t spending alot of money on travel, food, drinks and other consumptions, they will have more savings. This money is saved and should buy them roughly the same amount of products and services between the moment the money is saved and when it is spend.

And this is where Bitcoin fails as a store of value for regular consumer behaviour. Predicting how many US Dollars or how much gold you need to buy a certain product in the next comming months is more easy than predicting how many Bitcoins or Satoshi’s you will need.

This is because the cryptocurrency isn’t stable, but volatile in value.

Household would probably prefer using fiat currency as a store of value, except when inflation is too high, since the amount of US Dollars needed to buy bread is more easy to predict in the comming two years than the amount of Bitcoin needed to buy one leaf of bread. There are however more functions on which we can compare Bitcoin with other assets.

Bitcoin as a medium of exchange

Bitcoin cryptocurency wins from gold as a medium of exchange in this comparison. The reasons will be explained in my book more thoroughly, but goes like this. Anyone, anywhere can use the Bitcoin system. He or she can send Bitcoins over the internet and buy a variety of products and services, while using phsyical gold for these kind of transactions takes more time and energy to complete. Bitcoin can also be easily split into smaller parts to provide for the exact sum of payment of the transaction. Therefore, Bitcoin outperforms gold on this specific function of money.

If you want to learn more about this comperative analysis you should buy my book.

Conclusion

The Bitcoin system can be used for a variety of use cases, but does not yet perform well on all of the functions of money. More reasons why this is the case can be found in my book.

Discover Bitcoin with this e-book

Language: English

Pages: 202

ISBN-13: 979-8702244174

Publication date: January 30, 2021

Author: Teunis Dokter

Contributor: Edin Mujagić

On the Nature of Bitcoin is the complete book on the role of Bitcoin in the Digital Transformation. You will discover how Bitcoin protects itself from hackers, how it is used in cybercrimes, what the technical design of Bitcoin looks like and learn if the new crypto system is able to align to the four functions of money. And, of course, much more!